KRA has been digitizing many of its services to make it more convenient for tax-paying citizens to meet their tax compliance needs and to offer more transparency in the tax paying process. The newest product is known as the Electronic Tax Invoice Management System (eTIMS) which is a digital platform that enables business owners in the country to generate and transmit their invoices electronically to the government.

KRA made it a mandatory requirement for all taxpayers doing business to onboard eTIMS by 1st January 2024. Failure to comply with this requirement attracts a penalty that is twice the amount of tax due. Additionally, you will not be eligible to deduct the expenses in arriving at taxable income for corporation tax purposes.

What are the benefits of eTIMs?

The platform prides itself in being simple, convenient and flexible. It offers a number of benefits to users including:

- Users can access eTIMS from a number of devices including laptops, smartphones, tablets, and Personal Digital Assistants (PDAs). This makes it easy to use the services available on the platform from anywhere.

- The services are provided free of charge which reduces operation cost for businesses.

- Users can enjoy other services such as stock management, which allows them to maintain their own inventory, and record maintenance, which provides accuracy in tax invoice declaration and reconciliation.

Who is meant to use eTIMs?

According to the provisions of the Finance Act 2023, all persons engaged in business, whether registered for VAT or not, are required to electronically generate and transmit their invoices to KRA via eTIMS. This includes:

- Companies, partnerships, sole proprietorships, associations, trusts etc.

- Persons with income tax obligations such as Rental Income (MRI) Tax, Turnover Over Tax (TOT), Annual Income Tax – for Corporations, Partnerships and Individuals, both resident and non-residents with a permanent establishment.

- Persons conducting business in various sectors, including the informal sector.

- Persons in business whether or not registered for VAT. Persons in business but not required to register for VAT e.g. persons supplying VAT exempt goods and services such as hospitals supplying medical services, schools supplying education services, tours and travel agents, NGO’s in business etc

Who is exempt?

According to the Tax Procedures (Electronic Tax Invoice) Regulations 2023, these are the only businesses and transactions that are exempted from the requirement to comply with e-TIMS:

- supplies by a resident person whose annual turnover is less than five million shillings

- imports, interest, emoluments, airline passenger ticketing and similar payments

- investment allowances including internal accounting adjustments, fees charged by financial institutions, and services provided by a foreigner without a permanent establishment in Kenya

How to register for eTIMS

The process of registering for eTIMS is easy and straightforward. It only takes a few minutes to complete and the prompts are easy to follow.

- First, you need to download and fill out the eTIMs commitment form then proceed to the eTIMS portal

- On the portal, click on the sign up button then click on the Pin button

- Enter your KRA PIN number, fill in the taxpayer’s details including name, taxpayer type, mobile number and email and click on the verify button

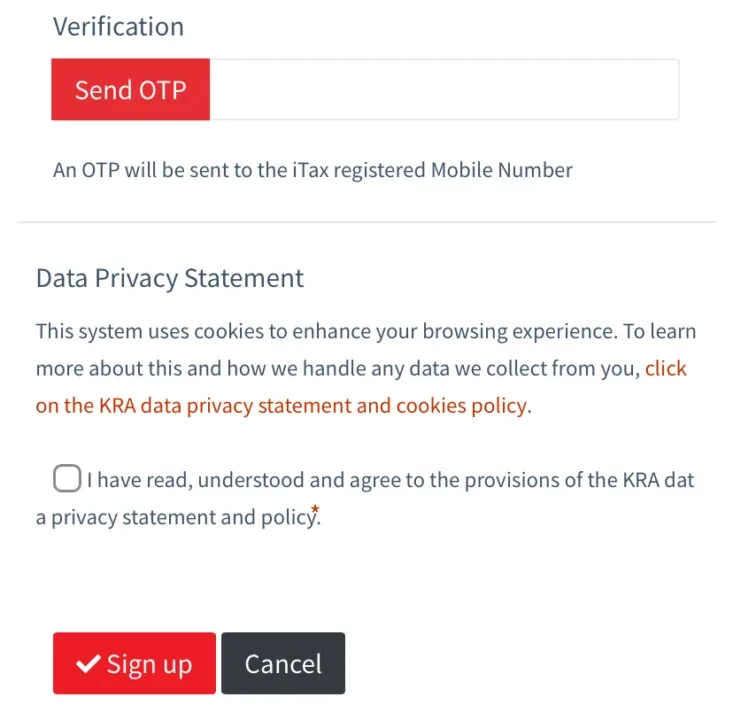

- Create a password then select the Send OTP button to receive a security code.

- Enter the security code and check the confirmation box to verify that you have gone through the data privacy statement

- Click on the sign up button to create a profile

- To enter the eTIMs portal, you will be prompted to enter your UserID (KRA PIN) and password

- On the Home page, click on Service request button on the top right corner then click on the eTIMS 2.1 button

- Click on the drop down button under the eTIMS type and select a suitable software solution for your business

- Fill in the mandatory space and attach the required documents then click the send button

- A confirmation button will pop up to verify whether you want to apply for the software solution. Click yes to confirm.

- A message will be sent to the applicant to inform them if their application was successful or not