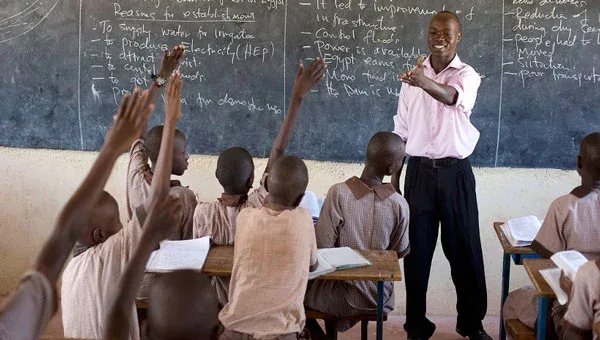

Teachers are a key pillar of our nation, from shaping young minds to inspiring the next generation of leaders. However, just like every other Kenyan they also have dreams and aspirations that require support for their fulfillment. It is due to this that Family Bank unveiled their check-off loan facility specifically designed for Teachers Service Commission (TSC) employees.

A check-off loan can be termed as a form of short-term credit that allows salaried individuals to borrow money based on their monthly income.

Here is what you need to know about the Family Bank TSC check-off loan.

Loan Amount

Teachers are able to access up to Ksh. 6 Million which they can pay back in affordable amounts. This amount is enough to enable one to invest in a business, purchase a car or even purchase a plot of land and build your dream house.

Loan Term

Other than the interest rate, the other aspect which can make a loan to be expensive is the loan term. A shorter loan term has an effect of making a loan expensive because one as to make higher payments on a monthly basis.

Being cognizant of this, the Family Bank TSC loan has a loan term of 132 months. This longer repayment period allows for one to be able to pay back the loan in affordable monthly installments.

Insurance Cover

The TSC loan comes with an insurance cover which is able to pay off the loan in the event of death or permanent disability of the loan applicant. This is important because in the unfortunate instance where there is no cover, the family of the deceased would have been forced to pay off the loan.

Check-off Arrangement

The loan is repaid via check-off which means that the employer in this case TSC deducts and remits the repayment on your behalf. This eases the stress of one having to ensure that the loan repayments are being made and in a timely manner. With the forgetful nature of some of us, this is truly a life saver.

Top-ups

Already taken a loan and have paid back a considerable amount? One can be able to take a top-up which can help you sort out that urgent need such as paying for school fees or even paying off a medical bill.

Loan Buyout

For those who had taken out loans with other institutions and want to move to Family Bank. Worry not as they have got you covered, they can buy out your current loan enabling you to start enjoying the benefits of this scheme loan.

So, if you are a teacher and are looking get a facility that can enable you to upgrade your life. Look no further than the Family Bank TSC loan, all you have to do is visit any branch and get your loan processed within no time!!