Let’s assume you’ve never taken a loan or defaulted if you have taken one. There’s no reason you should care about a Credit Reference Bureau (CRB), right? Not quite. Whether you’ve taken a loan, defaulted or not, CRB still has an impact on your life. In fact, CRB has details of every ID card holder in Kenya and their credit history. They are the finance watchdog in the country and are mandated to keep track of people’s loans record. Hence there is always a need to get a CRB Clearance Certificate.

This allows other financial institutions to determine whether you’re eligible for a loan. Additionally, CRB can affect your ability to get a job or secure a government tender.

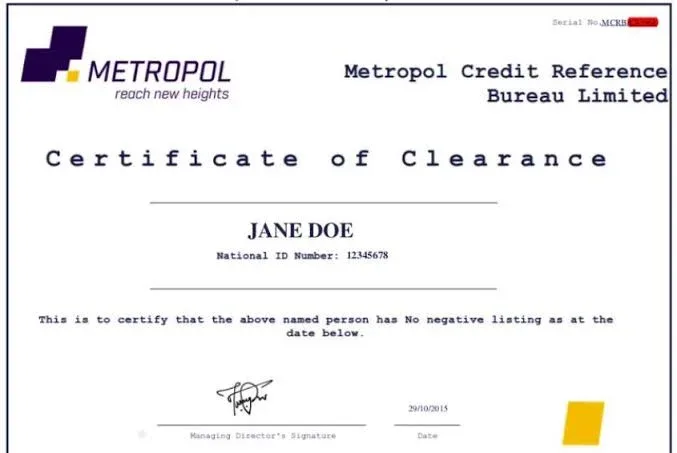

To show your credit status, you need to get a Credit Reference Bureau (CRB) clearance certificate. This is one of the documents that every Kenyan needs to have as it’s usually part of employment application requirements, loan applications and other applications.

There are 3 official CRBs in Kenya that can issue a CRB clearance certificate. These are CreditInfo, TransUnion and Metropol. These institutions usually check the applicant’s credit records and determine their status. If you have never taken a loan and defaulted then you will get a clean bill of health. If you have a loan that you are currently servicing, you can get a CRB clearance certificate that indicates you’re paying the loan. If you have a loan that you have fully settled, then the certificate will indicate that you have paid the loan.

Before applying for a CRB clearance certificate, you need to check your standing. Here’s how to do so:

Metropol

- Dial *433# then enter your ID number

- Confirm your details to complete registration

- Go to your MPESA menu and send Ksh 150 to Paybill 220338. Enter your ID as the account number

- Open the SMS to get a link, pin and reference number to access Metropol services

- Enter *433# to check your status

- Alternatively, download the Metropol app on Playstore then register and make the payment to view your status or visit the Metropol website and register then make the payment.

TransUnion

- Send your full names via SMS to 21272

- Enter your ID number then choose CC which stands for Credit Status

- You’ll receive a message stating either good or negative. This is your CRB status

- This service is free for first timers then after you’ll pay Ksh 650 to 212121 and your ID as the account number

CreditInfo

- Visit the CreditInfo website, sign up and request a credit report

- It will be sent to your email address

- This service is free for 1 year then you will be required to pay Ksh 350 per year for a report

You can apply for a CRB clearance certificate if you have a positive listing status. The process is simple and fast.

Metropol

- Visit the Metropol website and log in using your phone number and reference number

- Select Clearance Certificate then go to your MPESA menu and pay Ksh 2,200 to Paybill 220388 and your ID as the account number

- Follow the instructions on the website to download the certificate

TransUnion

- Send Ksh 2,200 to Paybill 212121 and your ID as the account number

- Forward the Mpesa message to the email [email protected]

CreditInfo

- Visit the CreditInfo website and select Personal Clearance Certificate or Company Clearance Certificate

- Enter the required details including your name, ID, and reason for applying for a clearance certificate then click Submit

- Pay Ksh 2,200 to complete the application

Note: CRB doesn’t give a clearance certificate if you have an outstanding non-performing loan. You need to settle the debt or make partial payments to activate your account and be eligible for a CRB clearance certificate.