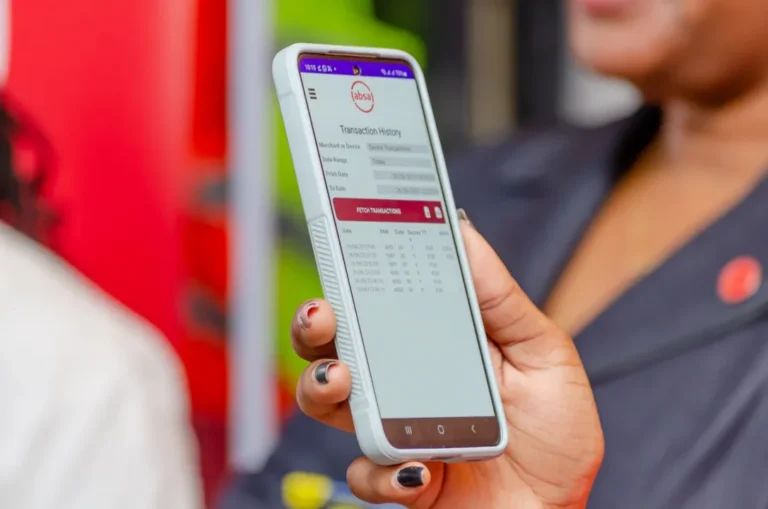

Absa Bank Kenya has partnered with Visa to introduce the Absa Mobi Tap solution. The solution allows small businesses to accept card-based payments from customers using an Android smartphone.

This solution quickens the purchasing process by leveraging the smartphone as a point of sale (POS). Customers can simply tap their debit or credit cards on an Android phone or tablet to make a payment.

Merchants will only be required to download the Absa Mobi Tap app from the Play Store onto their smartphone. Thereafter set up their profile and be ready to accept card payments without the need for a PDQ/POS machine. To process the payment, the merchant will enter the transaction amount, then the customer will tap their contactless card on the back of the smartphone and enter their PIN if required and complete the purchase.

Absa Mobi Tap makes use of Near Field Communication (NFC) capabilities. This facilitates communication between the merchant’s device and the customer’s contactless payment card. The solution is primarily aimed at small and medium-sized enterprises (SMEs). Particularly those with mobile operations that previously relied on cash or electronic funds transfer (EFT). The solution is already in use by merchants such as ride-hailing drivers, restaurants, salons and hardware shops.

Elizabeth Wasunna, Absa Bank Kenya’s Business Banking Director,said, “As a digitally-led bank, we are excited to introduce another first-to-market solution that provides merchants with an innovative and cost-effective solution for their day-to-day business. The new solution will enable businesses to accept contactless payments in a faster, easier, and more secure manner, facilitating the adoption of a cashless society for the benefit of all. This is yet another milestone in our journey to provide cutting-edge, tailored solutions to our customers.”

Under the Absa Mobi Tap proposition, Absa will offer an instalment plan to the merchants to purchase the NFC-enabled smartphones. The launch aligns with the recent introduction of a Standard QR Code for service providers and banks to boost digital payment usage in the country by making them easier, faster, more convenient and secure.