SC Juza is a mobile loan app that was launched by Standard Chartered Bank. It is essentially a service that allows customers to access mobile loans on the go.

The app is intended to meet the growing demand for short-term unsecured loans that are easily disbursed through mobile wallets.

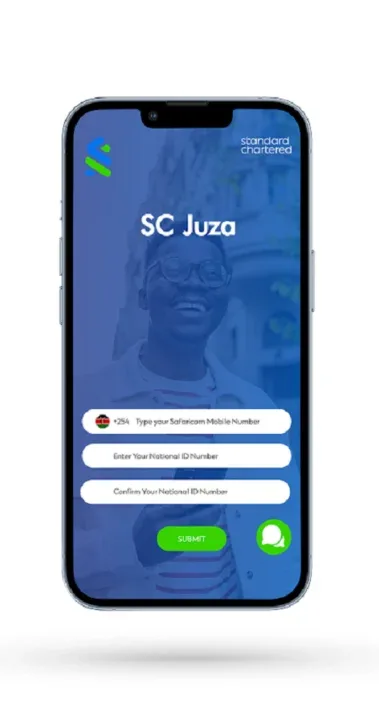

Here is how you can go about accessing a loan on SC Juza.

1. Signing up

To get a loan, you need to register by downloading the app on Google Play Store and keying in your details such as National ID number as well as your phone number. Unfortunately, the app is not yet on the iOS App Store.

2. Loans

Customers can apply for loans from as low as Ksh. 1,000 up to a maximum of Ksh. 100,000 depending on your repayment capability. One will need to have a proven track record of loan repayments and at least six-month M-PESA transaction history.

3. Loan interest

The charges on the loans are 1.6% per month with the beauty being that interest will only be charged on the days the loan is outstanding enabling clients to benefit from early repayments.

4. Repayment period

The repayment for the SC Juza loan is 60 days month or 2 months, however, one can be able to pay off the loan sooner depending on their cashflow.

5. Fees

The processing fee for each approved application is set at 5.5%, which means, for instance, a loan of KES 1,000 will incur a processing fee of KES 55.