Ecobank Kenya has launched of the Fingo Africa app which is targeted at young people in Kenya and across Africa. The app was developed in partnership with Fingo Africa, a Kenyan Fintech. The launch of the App in Kenya will be followed by a roll out across Ecobank’s pan-African footprint.

The Fingo Africa app empowers Africa’s youth by enabling them to open a bank account via their mobile phone in less than four minutes, send money to other Fingo users for free and to M-Pesa users and paybills via Paybills and Till numbers at subsidized rates. Users therefore get instantly rewarded whenever they use the App for their day-to-day transactions. Opening the Fingo digital account is free, safe and easy. It attracts no minimum balance and no monthly fees.

The app was developed as a response to the fact that accessing financial services can be a major challenge for young people in Africa today. Opening a bank account can be a lengthy process taking anywhere from two days to two weeks in some countries. Moreover, it may require multiple face-to-face interactions and the submission of physical paper documents. Often, consumers also face a steep fee when sending money to friends, loved ones, or businesses, in addition to other charges just to keep their account active.

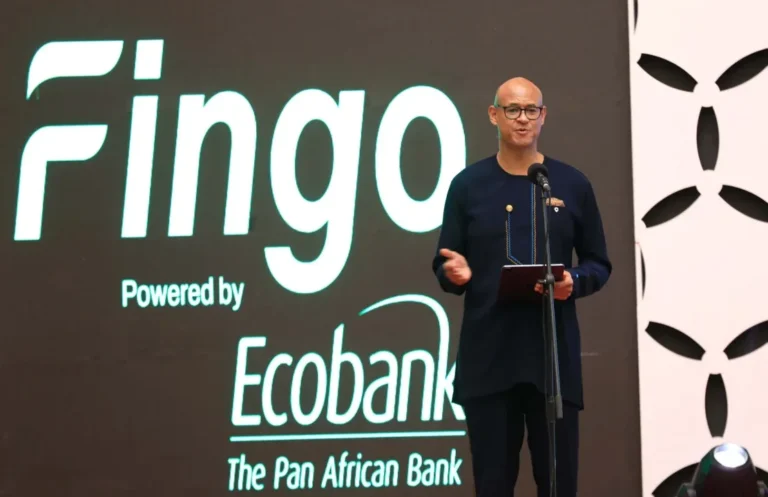

Jeremy Awori, CEO, Ecobank Group, said: “We are proud to support the deployment of the Fingo App, a game-changer in digital finance in Africa that brings many young people into the mainstream financial sector and caters to their needs and preferences. By simplifying access to finance, it overcomes the entrenched issues that have often acted as barriers to entry for young Africans. I want to thank our partner, Fingo, for driving such innovation that is aligned with one of our core missions to drive financial inclusion across the continent.”

Kiiru Muhoya, CEO and Co-Founder, Fingo Africa, stated: “We are delighted that our Fingo Africa app will accelerate financial inclusion for Kenya’s youth and empower them just by using their mobile phones. We are looking forward to rolling-out the app’s availability throughout Ecobank’s 33-country footprint, which will deliver on our vision of empowering Africa’s youth to create wealth in a way that is simple, fun and educative.”

Users of the Fingo Africa app can:

- Open a fully-fledged current account within 4 minutes as long as they have the relevant documents (i.e. a Kenyan ID or passport for now)

- Send money to fellow Fingo users for free and to M-Pesa at a subsidised rates

- Pay their bills from the App, make utility payments and buy airtime

- Save money easily for set goals and set recurring transfers to the set goals to create a frictionless savings habit

- Easily create and send payment links with full payment details to ease receiving payments from those who owe you

- Receive funds using QR Code

- Earn a cash reward by completing a few simple actions after self-onboarding

The Fingo Africa app is currently available in Kenya, prior to a wider roll-out across Ecobank’s entire 33-country sub-Saharan African footprint.